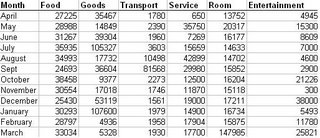

Figure 1. Spreadsheet of total categorized costs

Figure 1. Spreadsheet of total categorized costsTotal money spent: 1,626,189 Yen = 16,142.66 CAD (April 25, 2006. Source)

Annual costs in yen (divide by 100 for approximate costs in CAD)

Food = 369,667

Goods = 446,661

Transport = 113,246

Service = 226,081

Room = 324,560

Entertainment = 145,974

If there is one important number to look at it's the number in bold, that's how much in a year I spent-- that's $16k in a year. Actually this number should be closer to $20k because I was living somewhere really cheap, but this is approximately what it costs to live on your own. If you live at home and pay for 1/2 of your food then your yearly costs would be in the ball park of $11.5k/year. Yes, I am willing to bet that although you might not notice it, that you are spending around $10,000 a year in personal living expenses. A lot of money right? This includes dining out with friends, going on adventures, trips and buying stuff, add it all up and this is what it costs.

Personally, knowing the amount of money needed to survive at home isn't all that interesting. It's easy to survive when living at home, the real trick is determining how much money you need to make and how much is costs to live on your own. This essay would have been a little more provocative sounding had I said things in reverse... that you spend $10k living at home and mused at the question of the costs of living on your own. Too late, I've already said it backwards and I'm not too interested in reversing the order (I've already spent a considerable amount of time typing this log as it is already... and no, I didn't write this linearly [actually this was the last paragraph I wrote] :P).

So I served the main dish first. Prepare yourselves for appitizer and dessert next!

Up next, a pie chart of expenses:

Annual costs in yen (divide by 100 for approximate costs in CAD)

Food = 369,667

Goods = 446,661

Transport = 113,246

Service = 226,081

Room = 324,560

Entertainment = 145,974

If there is one important number to look at it's the number in bold, that's how much in a year I spent-- that's $16k in a year. Actually this number should be closer to $20k because I was living somewhere really cheap, but this is approximately what it costs to live on your own. If you live at home and pay for 1/2 of your food then your yearly costs would be in the ball park of $11.5k/year. Yes, I am willing to bet that although you might not notice it, that you are spending around $10,000 a year in personal living expenses. A lot of money right? This includes dining out with friends, going on adventures, trips and buying stuff, add it all up and this is what it costs.

Personally, knowing the amount of money needed to survive at home isn't all that interesting. It's easy to survive when living at home, the real trick is determining how much money you need to make and how much is costs to live on your own. This essay would have been a little more provocative sounding had I said things in reverse... that you spend $10k living at home and mused at the question of the costs of living on your own. Too late, I've already said it backwards and I'm not too interested in reversing the order (I've already spent a considerable amount of time typing this log as it is already... and no, I didn't write this linearly [actually this was the last paragraph I wrote] :P).

So I served the main dish first. Prepare yourselves for appitizer and dessert next!

Up next, a pie chart of expenses:

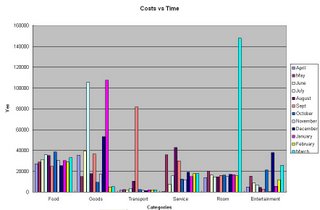

Figure 2. Percentage break down of expenses

Food 23%

Goods 27%

Transport 7%

Service 14%

Room 20%

Entertainment 9%

What is interesting to note is that my significant living expenses of living are food, goods and rooming fees which are all in the 20% range. Of an interesting note is that the amount of money I pay for services, like cell phone, gym subscription and etc. is low compared to the rest of my expenses. Now for those of you people that think I'm a total party animal, look at my entertainment expenses which sit at 9% of my total expenses. Considering that 2 days out of 7 are weekends, you'd expect a little more right? Perhaps I'm easily amused. But anyways, just as a note to everyone, it doesn't necessairly have to cost a lot of money to have fun. Just about $1,460 CAD over the course of a year (that equates to about ~$100/month in entertainment).

There is one jewel of information in this report that I should mention-- my transportation costs. Now compared to most people living in Vancouver my mode of transportation is totally differeny from what you guys are doing -- ie. I scooter! Now I did a short analysis of what is costs to have a car in Japan (link). My calculations showed that it costs an average of $200/month (including maintenance and not including costs to own!).

In Japan scootering costs me approximately $30~40/month including fuel, insurance and tire change (no maintenance for scooter yet). If you're wondering, I spend $20 on gas/month for transportation. I travel about 25 km/day, which is about a one way trip to UBC from Richmond. Of an interesting note, for a car, I spent $80/month going to and from UBC per month and other misc travels. To be fair, doubling my gas costs for my scooter will put it at $40/month for the same distance. --> scooters are considerably cheaper than a car just gas wise... but I made that point already after I gathered a month's data on my scooter and it's fuel efficiency :) With maintenance included that costs goes up to approximately $50/month. In comparison to a car, it's 1/4 the cost of maintaining a car for a similar level of mobility. Just as a note I have rented a car on several occasions for road trips and I have found that renting a car for when I needed is cheaper than owning one just from a maintenance perspective.

So let me make some more comments about my finances and the interesting things that I've learned... let's take a look at the next figure:

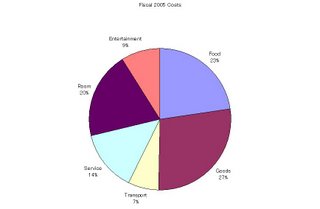

Figure 3 . Categorized costs by month

Figure 3 . Categorized costs by monthFigure 3. is where some deep information is; "pay" close attention. If you look at my data, you'll see that my food costs and rooming fees remained relatively constant over the entire year. The room fees took a huge spike in the last month due to me moving. The costs incured were paying down the first month's rent, 2 months worth of deposit and one more month's worth of money as the real estate's agent's cut for "finding" us the place and doing some of the paper work for us.

My food costs remained at about $300/month and rental costs remained at $150/month (utils included). These are fixed living expenses and the important thing is that fixed expenses are uninteresting parts of finance. But in finance *boring* is good, because it means stability! Now for the interesting stuff-- variable costs.

Now if you looked at my data, you will notice some blips in my chart. Those blips come from large purchases, in particular my trip to Taiwan ($500), my new camera ($1000), scooter ($600) and moving into a new appartment ($1200). These are my most notable expenses from my speadsheets. Adding these together the total becomes $3300. Now if you compare this expense with my total fiscal expenses of $16,000 you'd see that these 4 significant expenses made up 20% of my total expenses!

Compare this data to my expenses and you'll be able to notice that that's equivalent to an entire year's supply of food! That's how significant how a few big price tag items can inflate yearly expenses. I most humbly believe that if there was something overlooked, it's the variable costs when it comes to financial managment because you're never going to know how much these things are going to cost. Now, over a long enough time span, you'd should be able to determine on average how much extra cash you should expect to spend in variable costs (ie random large purchases or expenses).

I should also comment that making large purchases does not happen randomly! Actually, the size of a random large purchase is proportional to the amount of money you have saved and the amount of money to expect to earn (hence, it determines how willing you are to spending it!). I fully expect that my expenses to change with time if/when I start making more money (or when I have more money available). This means that your finances will change over time as your income changes... but that should be obvious. The intereting question is, "how does it change?" (Assuming your living conditions stays fairly consistent). The question boils down to.. if you had more (or less) money, what would you do? And that's a question that many economists ask themselves and a question that (maybe) Apple's iPod is answering (as a random example).

So there you have it. $16k in a year of living expenses (not including savings), aim higher everyone because you need savings and more. That's it for me. Comments welcome.

Note to self: 1,400 words written in 3 hours.

Now if you looked at my data, you will notice some blips in my chart. Those blips come from large purchases, in particular my trip to Taiwan ($500), my new camera ($1000), scooter ($600) and moving into a new appartment ($1200). These are my most notable expenses from my speadsheets. Adding these together the total becomes $3300. Now if you compare this expense with my total fiscal expenses of $16,000 you'd see that these 4 significant expenses made up 20% of my total expenses!

Compare this data to my expenses and you'll be able to notice that that's equivalent to an entire year's supply of food! That's how significant how a few big price tag items can inflate yearly expenses. I most humbly believe that if there was something overlooked, it's the variable costs when it comes to financial managment because you're never going to know how much these things are going to cost. Now, over a long enough time span, you'd should be able to determine on average how much extra cash you should expect to spend in variable costs (ie random large purchases or expenses).

I should also comment that making large purchases does not happen randomly! Actually, the size of a random large purchase is proportional to the amount of money you have saved and the amount of money to expect to earn (hence, it determines how willing you are to spending it!). I fully expect that my expenses to change with time if/when I start making more money (or when I have more money available). This means that your finances will change over time as your income changes... but that should be obvious. The intereting question is, "how does it change?" (Assuming your living conditions stays fairly consistent). The question boils down to.. if you had more (or less) money, what would you do? And that's a question that many economists ask themselves and a question that (maybe) Apple's iPod is answering (as a random example).

So there you have it. $16k in a year of living expenses (not including savings), aim higher everyone because you need savings and more. That's it for me. Comments welcome.

Note to self: 1,400 words written in 3 hours.

3 comments:

Great Analysis! I'll reread in more detail when I get to doing my finances. At least I'm already gathering the raw data!

Hope you found the article useful! When you do get your data put together, I'd like to take a peek at it and make a comparison of living expenses in Japan than those in Canada (well Toronto atleast :)

i'm interested in visiting Sendai, Japan in the summer. Would you know where I can find cheap rent for the summer.

thanks

Post a Comment