Governance of Online Communities

Internet communities are a fascinating thing. They are born in all sorts of online environments, whether they be bulletin boards, IRC, newsgroups, virtual worlds and more. All of these communities are self governed. Rules of the medium usually written out by some benevolent person expressing the sentiments of those that frequent the medium, for example how to conduct one's self and treat the medium, whether it be the chat room or some online forum.

The leaders of these communities are not elected, they just are simply recognized and followed by those who see them as fit. You will know who the leaders are in an online community, they are the ones doing the charitable acts of good deeds for the community to help it flourish. They are the ones posting up FAQ lists or selflessly taking the responsibility to manage the community.

We see this everywhere, whether it be in an online virtual world like World of Warcraft with a guild leader and members or even an online photo sharing site like flickr where people share wonderful photos and tips on how to take great shots. We see the same thing even in software where the likes of Linus Trovalds is the undisputed leader of the Linux project, though he was never elected into that position.

You can't declare yourself a leader

As much as many people would like to become a leader, you just can't declare that you are a leader and expect people to follow you. Leadership doesn't work like that. Image a person that waltzes into some community, declaring that he wants to be the new administrator and institute all sorts of "improvements" and that everyone should support him. A scenario like that will usually end up with everyone flaming (which is internet speak for "insulting") him and finally ignoring him. To have someone simply walk in and declare themself a leader is absurd as a random person declaring himself as the King of France. How would you know that this person will do their best for the community? It would be like some politician deciding to run against Linus Trovalds to manage the Linux operating system project. Linus pretty much embodies the Linux project.

Quite the contrary to the above process, determination of leadership is done in exactly the opposite manner-- it is the people that choose to follow you. The most common reasons for people to follow someone's leadership is a combination of vision, ability and altruism that defines the best leaders. I am quite certain that nobody that would want to follow a leader that is visionless, incompetent and selfish. The simple act of trying to declare yourself a leader is already selfish, if not egotistical.

The best leaders of online communities have and always been the people that spent their time helping others and the community at large. If you can think of online games with virtual worlds and clans, the people that are at the top of such an organization are the ones that helps the community the most, whether it be though player training, game play coordination, developing a webpage for the team or whatever. The same can be said for online discussion forums, where the most recognized people are the ones that provide the most insightful discussions and those that do their best to answer or direct people with questions to sources where they can find the answers they seek. You don't have to be elected into some position of power to do acts of good will, every person has the tools to do so. Yet, when in terms of our offline communities, our reality is quite the opposite.

Tyrants and the Governance of Offline Communities

When it comes to leadership in real world communities, things take a very different turn, especially when it comes to governance of largest community of all, the country. I have always found it strange that most politicians are usually well off individuals with the financial capital to run an election campaign to collect votes to become leader and represent a community in a governmental position. Yet they lack evidence in what they have done in the past to the benefit of the community before running for this position.

If you were simply to listen to the advertisements of these people, all that you will hear are the things that they want to do for you; their promises, agendas and vision. Perhaps the only characteristic of a leader these people have is vision. But a person that has vision but lacks ability in only a dreamer, a person with both vision and ability but lacks altruism may end up being a tyrant. And unfortunately, the history of politics has been often dominated by tyrants.

The Openness of Web 2.0: The Collaborative Effort

The defining difference between online communities and real world communities is the openness in which the online communities operate. Projects such as wikipedia operate on this basis where the entire database of encyclopedic information is open to public edits and additions which has allowed the online encyclopedia to flourish and be one of the first stops on the internet for people wanting to get a good summary of nearly any topic.

It would be impossible for Wikipedia to be as successful as it is today as an encyclopedic source without its open collaborative nature. It was at first proposed that people submit articles to Wikipedia and the contents would be reviewed by designated experts. Wikipedia never did start to take off until it was a fully open system, generally governed by the users that add content to the encyclopedia.

Such an open system is, of course, open to abuse. But the beauty of such a self-governing system is self-correcting, with the users of the wikipedia taking the responsibility to keep the entries as truthful as possible. Wikipedia users have found US politicians editing their own and the profiles of others for politically motivated reasons by tracking the editor IP addresses to government institutions. At first edit wars occurred trying to prevent malicious users from corrupting the entries (these entries usually have to cite sources to be credible). Finally, the Wikipedia community and administrators responded by restricting edits of political entries to more credible members that have contributed to the project over a longer period of time, after much discussion on the message boards. Without this kind of openness such behavior could not be caught, nor could the community be as well organized to come up with a viable solution.

Bringing the Collaborative Effort to Government

Democracy has origins dating back to 500 BC in Greece and possibly earlier to 2500 BC in Mesopotamia. The selection of representatives in a Democratic government was done because it was too impractical to have the general public involved in policy decision. It was more efficient to have a smaller number of people involved to set policies with checks on representatives to prevent abuse of executive powers for personal gain. Instead of having everyone vote on every issue, you now have a smaller number of representatives voting on issues for the people they represent. Interestingly, this is the same collaborative efforts that Web 2.0 strives to attain in a more primitive form.

But now with the internet and our ability to quickly communicate, the limitations of a traditional democratic government by elected representatives can now be alleviated. Instead of representatives acting on our behalf, the general public can now be involved in a collaborative effort to set policies and enact laws. The expertise of everyone can be leveraged in a wider variety of fields, compared to the limited knowledge base of a single politician. For example, public domain government funding and statistical data could be quickly analyzed and leveraged by experts through prudent open review with important discussions held in online forums. The discussions can also be referenced back to in the future. Finally, a policy can be set and a person or an organization can be selected to carry out the task.

Having everyone active in every aspect of government management is not necessary as seen in the Wikipedia example. Participation should be optional. We will find that altruistic people with sufficient knowledge and expertise will be the ones making the best decisions for the public at large. Decision making related information and analysis can all be posted online and referenced, giving people a far better understanding of a whole issue. Should a person have an interest in a specific bill, they have the option of voting on it, else abstaining from the vote, as voting on every bill would be very tedious.

A web 2.0 style of collaborative government management by the general public would be beneficial in increasing government efficiency, transparency, and accountability. Most importantly of all, the system is even more democratic by allowing everyone direct input into the governing process.

Of course, by allowing everyone to participate in the governing process, the amount of white noise ideas from the sheer number of people involved could be cumbersome, however, techniques of filtering white noise from good ideas/information is already well developed as seen on the internet. Google as one example being able to sift through billions of webpages to return relevant search results in a fraction of a second and information aggregate sites such as Digg and Reddit, where submitted links are ranked by users voting up or down on these links. The most interesting links will generally filter up to the top of the list.

With the current state of technology as it is now, implementing a form of government like this is a very feasible concept. I do believe that this concept could mark a new era of governance, the concept of a collaborative government.

Sunday, July 22, 2007

Friday, July 20, 2007

Currency matters for trading

It is no secret that the US dollar has been in decline for the past 5 years. Today, I decided to take a further look at this against the CAD, Euro and the Japanese Yen and came up with this plot using UBC's Sauder School of Business's pacific exchange rate service.

The Canadian dollar and the Euro is currently up 50% as discussed in a previous post. The Japanese yen, not doing as well, is up 10% over the last 5 years. Now considering the following case, suppose that you were a US resident investing in Canada or Europe with a 10% yearly return on those investments. The return on those investments would yield a 61% portfolio increase. Now, if one were to add in the currency effects in to the equation, a 140% portfolio increase would result. The net returns from a portfolio also taking advantage of long term currency changes can double the capital gains made on an investment.

As a result of this, it is not just important to know how well the company is doing, but one should also take into account how well the currency will do in the future when making investment decisions.

The Canadian dollar and the Euro is currently up 50% as discussed in a previous post. The Japanese yen, not doing as well, is up 10% over the last 5 years. Now considering the following case, suppose that you were a US resident investing in Canada or Europe with a 10% yearly return on those investments. The return on those investments would yield a 61% portfolio increase. Now, if one were to add in the currency effects in to the equation, a 140% portfolio increase would result. The net returns from a portfolio also taking advantage of long term currency changes can double the capital gains made on an investment.

As a result of this, it is not just important to know how well the company is doing, but one should also take into account how well the currency will do in the future when making investment decisions.

Wednesday, July 18, 2007

July 24th 2007

My final defense will he held this coming Tuesday and I will be making my presentation to 4 professors, 2 of which are from my lab and 2 others in the Nanomecanics department. My presentation is largely done weighing at 40 some odd slides. I will be trimming this presentation down to 20 minutes and to allow 10 minutes for questioning. I find it rather interesting that I will be summarizing 2 years of work into 20 minutes.

After that, I will be waiting for a response from the conference organizers that will be hosting a conference in Denmark. If things go well, I will he hoping to attend a nanotechnology conference somewhere in September for about 4~5 day in Demnark and perhaps do some traveling around Europe if I can swing that.

This will be a busy next few months, but I will be looking forward to it.

After that, I will be waiting for a response from the conference organizers that will be hosting a conference in Denmark. If things go well, I will he hoping to attend a nanotechnology conference somewhere in September for about 4~5 day in Demnark and perhaps do some traveling around Europe if I can swing that.

This will be a busy next few months, but I will be looking forward to it.

Thursday, July 12, 2007

The US Economy in Trouble

There has been lots of news recently in terms of the health of the US economy. The news is looking grim in terms of many indicators.

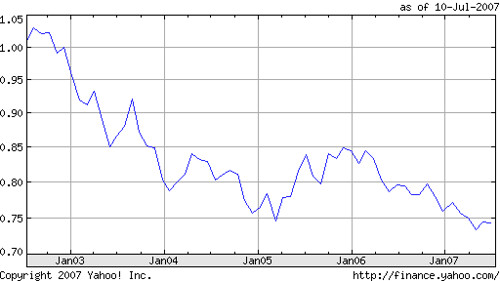

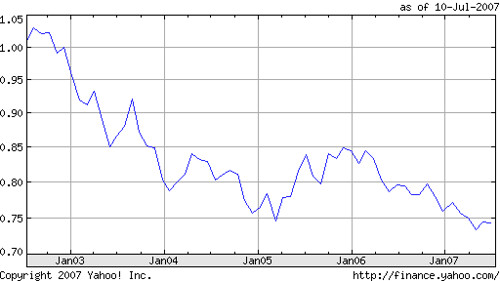

The US dollar has lost over 25% of it's value over the the last 5 years compared with the Euro as seen in the chart below.

The number of Euros 1 USD can buy

The same is also happening against the Canadian dollar as seen in the next chart.

The number of Canadian dollars 1USD can buy

We see here, that over the last 5 years, the US dollar has lost close to 40 cents in value from $1.5 CAD to $1.1 CAD which also represents a 25% drop in the American currency.

Why is this happening? A lesson in inflation

This is the result of the US government going into further debt with the funding of the Iraq war and the currently worsening economy.

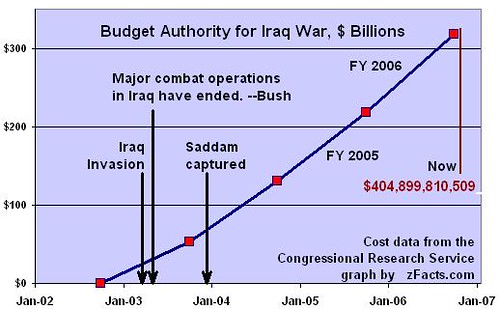

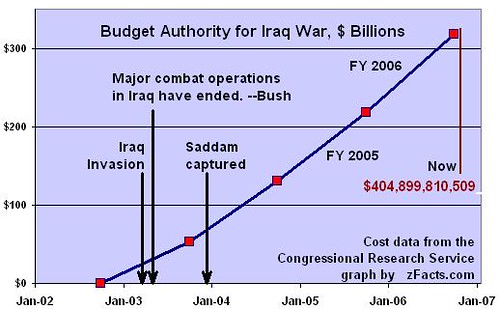

In terms of the Iraq war, the US government, to-date, has spent approximately $400 billion USD to since it's beginning in 2002. The money obviously had to come from somewhere and it is not likely that the US government kept a stock pile of cash to pay for the war since they were already in debt at that time. What the US government had to do is to take loans from other countries to finance this war.

The graph above here is the total amount of money spent on the war as time goes on.

How this war is financed is through the US taking loans from other countries in the form of treasury bonds which are promissory notes that the US government will repay those countries with US currency after a certain number of years with interest. Foreign countries buy these bonds using their currency to purchase them in USD. For example, a US treasury bond could go for $100,000 and the US government would put a guarantee that the US will pay interest on the money borrowed for as long as the money is borrowed until is it paid off. The rate is in the ballpark of 2% every 3 months.

The value of a currency is also set against the loans of a country makes against others. The value of a currency against others is controlled through inflation. Inflation is traditionally thought as the rate of increase of money in circulation which cases the price of goods and services to increase. For example, if everyone had $100 in their pocket one year and because the US prints more money every year and distributes it, everyone might have on average $103 in their pockets the next year. As a result, merchants know they can increase their price to get people to pay more for their good and services because of the availability of money in circulation.

It's like saying that in America, everyone carries $100 in their pockets and buys a drink for $1 and in Mexico everyone carries 1000 pesos and buys a drink for 10 pesos. Costs are relative in relation to the amount of money in circulation. In other words, printing more money means that the currency is devalued, making it less valuable. This makes sense because the more rare something is, the more valuable it is. This is actually why gold was used as a standard for currency long ago and money was actually backed by gold. It isn't anymore and unbacked money is called fiat currency. I could go into a separate conversation about fiat money but it will end up as a lengthy conversation which I have no plans on covering at this time (if you are interested, you are welcome to read up on it on your own).

One way that the US government pays for things is through printing money, which the government uses to pay for goods and services. The government actually makes money come out of thin air and pays for things with it. This is what is often called the "invisible tax" because the money which people have is devalued to let the government pay for things by printing money and increasing the money in circulation. This is the heart of the concept of inflation. In actual fact, the government doesn't actually print it's money, but a government/private controlled bank called the Federal Reserve prints the money and the US government takes loans from this bank to pay for things. But despite this, the fundamentals remain the same.

The effects of inflation and debt on currency valuation (and international trade)

Now this concept becomes very fascinating when it comes to international trade and financing. In order to finance the Iraq war, for example, the US requires resources to wage it's war. It simply just can't print money and distribute it to within the US and expect more resources to come out of thin air-- though money can be created from thin air, resources on the other hand cannot be pulled out of thin air. The US must also trade with other countries to get the resources it requires.

There are two ways which the US can pay for things from another country, the first is through cash payments, which the US must print and distribute to these countries. The problem with this method is that the US must print exorbitant amounts of money to send to these countries which will thus increase the amount of US money circulating in the world and immediately result in the devaluation of US currency.

This is obviously undesirable because you have an effect of diminishing returns. For example, the first time you have to pay $1 billion to get 500,000 barrels of oil. The second time around, you need to pay $1.3 billion to get 500,000 barrels of oil, every time that money needs to be created to buy things, the currency is devalued. This becomes a problem for everyone in the US, especially for international businesses. When the currency becomes devalued, it becomes harder for companies in the US to import things or pay for foreign labor.

For example, if the salary of a Chinese worker was 76,000 yuan a year which costs a US company $10,000 USD to fund. Through currency devaluation, US companies may have to pay $12,000 in salary the next year and then $13,000 a year to fund the same 76,000 Chinese yuan a year of that worker to make goods for import into the US market. Currency devaluation has very serious impacts on international trade. Just to let you know, Apple manufactures its iPods in China and could face rising costs because of the devaluing US dollar. If the US dollar declines too much, Apple may have to increase the costs of an iPod because the US dollar is worth less to pay for things abroad.

Instead of doing this, a second method is used to more gradually increase the amount of US money in circulation which comes in the form of US treasury bonds as loans as mentioned earlier. US treasury bonds are far less liquid (not easily exchangeable) and pay an amount of interest in every period of time (ie. every 3 months, every year etc) . Since treasury bonds is not real cash and because it pays interest gradually, devaluation of the US currency is thus gradual until it has to return the money at the end of the loan term. If the economy is good, the US government will probably have the money in the end and can pay off it's loans without trouble, if it doesn't, the government needs to print the money, resulting in USD devaluation.

Measuring economic health and a country's ability to pay off debt

The alternative to printing money and devaluing the US currency is to produce goods and services that foreign countries want to buy from the US to offset these costs. To explain this, suppose that you have many successful companies in the US making many useful products and exporting them to countries around the world. These companies make money from international trade which is then taxed and becomes money that the US government can use to run programs and/or pay off it's debt. The more successful the US companies are, the more income the government can make and the easier it is for the government to pay off the debt.

So, then, let's take a look at the trade balance of the US in international trade which I have taken from wikipedia and is posted below for reference.

The US trade deficit since 1991

By looking at this chart, we can observe that for the past 14 years that the US trade deficit has been increasing yearly and becoming more and more negative. What this means is that the US is borrowing or paying out more and more money yearly because it imports more than it exports.

I see two possible causes for this problem. The first possible cause is that US per capita consumes far too much and it driving itself into debt from over consumption. The second reason is a result of economic weakness of the US in the international market leading to exports not keeping up with imports. I believe that the US faces a combination of both problems due to outsourcing of work and manufacturing and massive imports from other countries like China. What this means is that the US is getting goods from imports while not producing enough exports to keep a fair balance in trade.

The current US economic future is DOOMED

Based on increasing governmental debt and the growing trade deficit, the US economy will continually get worse. The US debt and the trade deficit is increasing yearly, meaning that the US currency will be further devalued. As many US companies have outsourced or import goods from abroad, the outsourced work and goods will become more expensive, thus diminishing the profits of US based companies. Imported goods will be less affordable in the future, reducing the purchasing power of the ordinary citizen... whom are already in debt with high loans and interest rates.

The prospects for the US economy are grim and I would advise against making long term investments in the US due to weakening economic conditions. The currency will continually drop as the economy weakens. An economic crash may occur in the US which may bring down the currency further. Investing in the US might become good after this crash when the economy has stabilized and the currency is cheap enough for international companies to consider investing in the US.

Though this is speculative, I believe that poor foreign and local economic policies have led to increased governmental debt and the weakening of the US economy. The problem is largely due to the government spending too much on the Iraq war and then requesting that US citizens spend more (as in take on more debt) to finance the government debt through taxes. I do not believe that the US economy will be able to support the debt in the future, unless changes are made. The US government has made poor financial decisions and despite it's poor approval rating of 29%, the general population has done a poor job of holding the government accountable.

As a result of these findings, I believe that exposure to US currency should be reduced (ie. if you have US money, sell it off). Warren Buffet has also made a similar play a few years ago by selling his US money against other currency in 2002. I also advise against investing money in the US index funds which are measuring the metrics of the US economy and would invest outside of the US.

It is unfortunate that the future of the US economy looks like this and the impact it will have on it's citizens, but until attitudes change, nothing much can be done to change the current state of things.

The US dollar has lost over 25% of it's value over the the last 5 years compared with the Euro as seen in the chart below.

The number of Euros 1 USD can buy

The same is also happening against the Canadian dollar as seen in the next chart.

The number of Canadian dollars 1USD can buy

We see here, that over the last 5 years, the US dollar has lost close to 40 cents in value from $1.5 CAD to $1.1 CAD which also represents a 25% drop in the American currency.

Why is this happening? A lesson in inflation

This is the result of the US government going into further debt with the funding of the Iraq war and the currently worsening economy.

In terms of the Iraq war, the US government, to-date, has spent approximately $400 billion USD to since it's beginning in 2002. The money obviously had to come from somewhere and it is not likely that the US government kept a stock pile of cash to pay for the war since they were already in debt at that time. What the US government had to do is to take loans from other countries to finance this war.

The graph above here is the total amount of money spent on the war as time goes on.

How this war is financed is through the US taking loans from other countries in the form of treasury bonds which are promissory notes that the US government will repay those countries with US currency after a certain number of years with interest. Foreign countries buy these bonds using their currency to purchase them in USD. For example, a US treasury bond could go for $100,000 and the US government would put a guarantee that the US will pay interest on the money borrowed for as long as the money is borrowed until is it paid off. The rate is in the ballpark of 2% every 3 months.

The value of a currency is also set against the loans of a country makes against others. The value of a currency against others is controlled through inflation. Inflation is traditionally thought as the rate of increase of money in circulation which cases the price of goods and services to increase. For example, if everyone had $100 in their pocket one year and because the US prints more money every year and distributes it, everyone might have on average $103 in their pockets the next year. As a result, merchants know they can increase their price to get people to pay more for their good and services because of the availability of money in circulation.

It's like saying that in America, everyone carries $100 in their pockets and buys a drink for $1 and in Mexico everyone carries 1000 pesos and buys a drink for 10 pesos. Costs are relative in relation to the amount of money in circulation. In other words, printing more money means that the currency is devalued, making it less valuable. This makes sense because the more rare something is, the more valuable it is. This is actually why gold was used as a standard for currency long ago and money was actually backed by gold. It isn't anymore and unbacked money is called fiat currency. I could go into a separate conversation about fiat money but it will end up as a lengthy conversation which I have no plans on covering at this time (if you are interested, you are welcome to read up on it on your own).

One way that the US government pays for things is through printing money, which the government uses to pay for goods and services. The government actually makes money come out of thin air and pays for things with it. This is what is often called the "invisible tax" because the money which people have is devalued to let the government pay for things by printing money and increasing the money in circulation. This is the heart of the concept of inflation. In actual fact, the government doesn't actually print it's money, but a government/private controlled bank called the Federal Reserve prints the money and the US government takes loans from this bank to pay for things. But despite this, the fundamentals remain the same.

The effects of inflation and debt on currency valuation (and international trade)

Now this concept becomes very fascinating when it comes to international trade and financing. In order to finance the Iraq war, for example, the US requires resources to wage it's war. It simply just can't print money and distribute it to within the US and expect more resources to come out of thin air-- though money can be created from thin air, resources on the other hand cannot be pulled out of thin air. The US must also trade with other countries to get the resources it requires.

There are two ways which the US can pay for things from another country, the first is through cash payments, which the US must print and distribute to these countries. The problem with this method is that the US must print exorbitant amounts of money to send to these countries which will thus increase the amount of US money circulating in the world and immediately result in the devaluation of US currency.

This is obviously undesirable because you have an effect of diminishing returns. For example, the first time you have to pay $1 billion to get 500,000 barrels of oil. The second time around, you need to pay $1.3 billion to get 500,000 barrels of oil, every time that money needs to be created to buy things, the currency is devalued. This becomes a problem for everyone in the US, especially for international businesses. When the currency becomes devalued, it becomes harder for companies in the US to import things or pay for foreign labor.

For example, if the salary of a Chinese worker was 76,000 yuan a year which costs a US company $10,000 USD to fund. Through currency devaluation, US companies may have to pay $12,000 in salary the next year and then $13,000 a year to fund the same 76,000 Chinese yuan a year of that worker to make goods for import into the US market. Currency devaluation has very serious impacts on international trade. Just to let you know, Apple manufactures its iPods in China and could face rising costs because of the devaluing US dollar. If the US dollar declines too much, Apple may have to increase the costs of an iPod because the US dollar is worth less to pay for things abroad.

Instead of doing this, a second method is used to more gradually increase the amount of US money in circulation which comes in the form of US treasury bonds as loans as mentioned earlier. US treasury bonds are far less liquid (not easily exchangeable) and pay an amount of interest in every period of time (ie. every 3 months, every year etc) . Since treasury bonds is not real cash and because it pays interest gradually, devaluation of the US currency is thus gradual until it has to return the money at the end of the loan term. If the economy is good, the US government will probably have the money in the end and can pay off it's loans without trouble, if it doesn't, the government needs to print the money, resulting in USD devaluation.

Measuring economic health and a country's ability to pay off debt

The alternative to printing money and devaluing the US currency is to produce goods and services that foreign countries want to buy from the US to offset these costs. To explain this, suppose that you have many successful companies in the US making many useful products and exporting them to countries around the world. These companies make money from international trade which is then taxed and becomes money that the US government can use to run programs and/or pay off it's debt. The more successful the US companies are, the more income the government can make and the easier it is for the government to pay off the debt.

So, then, let's take a look at the trade balance of the US in international trade which I have taken from wikipedia and is posted below for reference.

The US trade deficit since 1991

By looking at this chart, we can observe that for the past 14 years that the US trade deficit has been increasing yearly and becoming more and more negative. What this means is that the US is borrowing or paying out more and more money yearly because it imports more than it exports.

I see two possible causes for this problem. The first possible cause is that US per capita consumes far too much and it driving itself into debt from over consumption. The second reason is a result of economic weakness of the US in the international market leading to exports not keeping up with imports. I believe that the US faces a combination of both problems due to outsourcing of work and manufacturing and massive imports from other countries like China. What this means is that the US is getting goods from imports while not producing enough exports to keep a fair balance in trade.

The current US economic future is DOOMED

Based on increasing governmental debt and the growing trade deficit, the US economy will continually get worse. The US debt and the trade deficit is increasing yearly, meaning that the US currency will be further devalued. As many US companies have outsourced or import goods from abroad, the outsourced work and goods will become more expensive, thus diminishing the profits of US based companies. Imported goods will be less affordable in the future, reducing the purchasing power of the ordinary citizen... whom are already in debt with high loans and interest rates.

The prospects for the US economy are grim and I would advise against making long term investments in the US due to weakening economic conditions. The currency will continually drop as the economy weakens. An economic crash may occur in the US which may bring down the currency further. Investing in the US might become good after this crash when the economy has stabilized and the currency is cheap enough for international companies to consider investing in the US.

Though this is speculative, I believe that poor foreign and local economic policies have led to increased governmental debt and the weakening of the US economy. The problem is largely due to the government spending too much on the Iraq war and then requesting that US citizens spend more (as in take on more debt) to finance the government debt through taxes. I do not believe that the US economy will be able to support the debt in the future, unless changes are made. The US government has made poor financial decisions and despite it's poor approval rating of 29%, the general population has done a poor job of holding the government accountable.

As a result of these findings, I believe that exposure to US currency should be reduced (ie. if you have US money, sell it off). Warren Buffet has also made a similar play a few years ago by selling his US money against other currency in 2002. I also advise against investing money in the US index funds which are measuring the metrics of the US economy and would invest outside of the US.

It is unfortunate that the future of the US economy looks like this and the impact it will have on it's citizens, but until attitudes change, nothing much can be done to change the current state of things.

Friday, July 06, 2007

How you can save $100,000 on a Mortgage

I have been doing some reading about the current problems with real estate in the US. According to many news articles I have been reading recently, there seems to be a lot of problems with people defaulting on their mortgage loans. As a result of this, there are more houses being put back into the housing market and analysts are currently worried about a housing bust. As a result of the news I have been reading, I wanted to see what does it take to successfully pay off a home mortgage.

Unfortunately, there are many people out there that have not done any financial calculations on how to pay down a mortgage and often have to rely on bankers to do the calculations for them. You are literally asking the fox to guard the hen house when you put yourself in that situation. It is the objective of the bank to get as much money out of you possible. Most people allow the bank to do exactly that by giving the bank your personal income details which allows them to come up with a payment plan for you which maximizes their profits. It is imperative that you do these calculations on your own before going to the bank to know what exactly you are getting into.

I have done some calculations today to get a general understanding of what a mortgage payment plan looks like and how much money will it take to pay it down in the long run. The results are startling because I have found that a $200 difference in your monthly payment can make a a $100,000 difference on the total amount of money spent paying down the mortgage. Yes, the results I present here can save you over $100,000!

The mortgage calculations have been done in an Excel Spreadsheet and I have made the following assumptions:

Home/Apartment Cost = $250,000

Down Payment = $75,000

Interest Rate = %7.5

Monthly Payment = $1,200~$1,400

Using these values, the initial outstanding mortgage balance is $175,000 and I have done the calculations to determine how much money and how long will it take for you to pay off the loan. I have plotted the results for monthly payments of $1,200, $1,300 and $1,400 and the results mortgage balance vs year plot is shown below.

The graph appears a little blurry but if you click on it, a better resolution version will come up.

The total amount of money paid yearly until the mortgage is paid of was then summed up for each different payment rate and the results are summarized in the table below.

The result of this calculation is very revealing. The $1,400 payment obviously allows a person to pay off the $175,000 loan the fastest at 21 years. By just decreasing the monthly payment by $100, it takes an additional 4 years, by reducing the monthly payment by $100 further, the time to pay off the loan takes an additional 13 years!

The difference between the total amount of money paid also varies greatly with the monthly payment rate. The calculations show that the total payment increases by $45,000 when you pay $1,300/month compared to $1,400/month. The difference becomes staggering when the payment rate drops by only $200 to $1,200/month with a difference of over $130,000. The banks would be more than happy for you to pay $1,200/month and extract more money out of you. A $130,000 difference is very serious money!

The result presented here is particular to this example and used as a reference only to this example. For other cases, I highly recommend that you perform your own calculations to know exactly what to expect at the end. Based on this result, I would be more than happy to save an additional $3/day to for nearly $100/month to save myself $45,000 in the long run. Save more daily and you will save more than $130,000 in this case. The results I present here are very profound and will definitely help you when it comes to saving significant amounts of money.

I should note that also if you borrow more money you also must expect to pay more monthly to have the debt paid off to reduce the amount of interest paid.

Unfortunately, there are many people out there that have not done any financial calculations on how to pay down a mortgage and often have to rely on bankers to do the calculations for them. You are literally asking the fox to guard the hen house when you put yourself in that situation. It is the objective of the bank to get as much money out of you possible. Most people allow the bank to do exactly that by giving the bank your personal income details which allows them to come up with a payment plan for you which maximizes their profits. It is imperative that you do these calculations on your own before going to the bank to know what exactly you are getting into.

I have done some calculations today to get a general understanding of what a mortgage payment plan looks like and how much money will it take to pay it down in the long run. The results are startling because I have found that a $200 difference in your monthly payment can make a a $100,000 difference on the total amount of money spent paying down the mortgage. Yes, the results I present here can save you over $100,000!

The mortgage calculations have been done in an Excel Spreadsheet and I have made the following assumptions:

Home/Apartment Cost = $250,000

Down Payment = $75,000

Interest Rate = %7.5

Monthly Payment = $1,200~$1,400

Using these values, the initial outstanding mortgage balance is $175,000 and I have done the calculations to determine how much money and how long will it take for you to pay off the loan. I have plotted the results for monthly payments of $1,200, $1,300 and $1,400 and the results mortgage balance vs year plot is shown below.

The graph appears a little blurry but if you click on it, a better resolution version will come up.

The total amount of money paid yearly until the mortgage is paid of was then summed up for each different payment rate and the results are summarized in the table below.

The result of this calculation is very revealing. The $1,400 payment obviously allows a person to pay off the $175,000 loan the fastest at 21 years. By just decreasing the monthly payment by $100, it takes an additional 4 years, by reducing the monthly payment by $100 further, the time to pay off the loan takes an additional 13 years!

The difference between the total amount of money paid also varies greatly with the monthly payment rate. The calculations show that the total payment increases by $45,000 when you pay $1,300/month compared to $1,400/month. The difference becomes staggering when the payment rate drops by only $200 to $1,200/month with a difference of over $130,000. The banks would be more than happy for you to pay $1,200/month and extract more money out of you. A $130,000 difference is very serious money!

The result presented here is particular to this example and used as a reference only to this example. For other cases, I highly recommend that you perform your own calculations to know exactly what to expect at the end. Based on this result, I would be more than happy to save an additional $3/day to for nearly $100/month to save myself $45,000 in the long run. Save more daily and you will save more than $130,000 in this case. The results I present here are very profound and will definitely help you when it comes to saving significant amounts of money.

I should note that also if you borrow more money you also must expect to pay more monthly to have the debt paid off to reduce the amount of interest paid.

Subscribe to:

Posts (Atom)