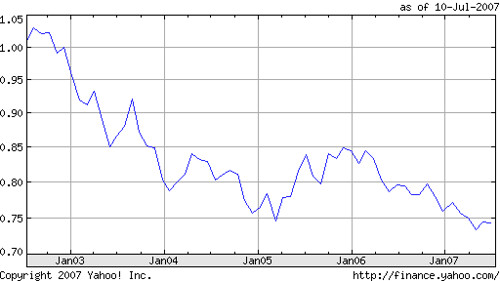

The US dollar has lost over 25% of it's value over the the last 5 years compared with the Euro as seen in the chart below.

The number of Euros 1 USD can buy

The same is also happening against the Canadian dollar as seen in the next chart.

The number of Canadian dollars 1USD can buy

We see here, that over the last 5 years, the US dollar has lost close to 40 cents in value from $1.5 CAD to $1.1 CAD which also represents a 25% drop in the American currency.

Why is this happening? A lesson in inflation

This is the result of the US government going into further debt with the funding of the Iraq war and the currently worsening economy.

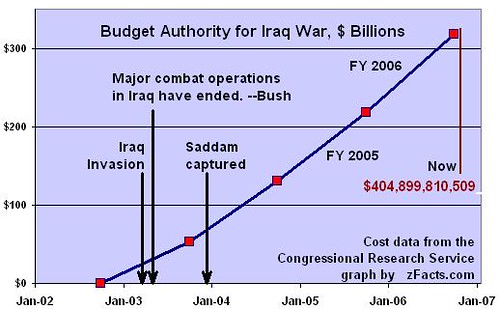

In terms of the Iraq war, the US government, to-date, has spent approximately $400 billion USD to since it's beginning in 2002. The money obviously had to come from somewhere and it is not likely that the US government kept a stock pile of cash to pay for the war since they were already in debt at that time. What the US government had to do is to take loans from other countries to finance this war.

The graph above here is the total amount of money spent on the war as time goes on.

How this war is financed is through the US taking loans from other countries in the form of treasury bonds which are promissory notes that the US government will repay those countries with US currency after a certain number of years with interest. Foreign countries buy these bonds using their currency to purchase them in USD. For example, a US treasury bond could go for $100,000 and the US government would put a guarantee that the US will pay interest on the money borrowed for as long as the money is borrowed until is it paid off. The rate is in the ballpark of 2% every 3 months.

The value of a currency is also set against the loans of a country makes against others. The value of a currency against others is controlled through inflation. Inflation is traditionally thought as the rate of increase of money in circulation which cases the price of goods and services to increase. For example, if everyone had $100 in their pocket one year and because the US prints more money every year and distributes it, everyone might have on average $103 in their pockets the next year. As a result, merchants know they can increase their price to get people to pay more for their good and services because of the availability of money in circulation.

It's like saying that in America, everyone carries $100 in their pockets and buys a drink for $1 and in Mexico everyone carries 1000 pesos and buys a drink for 10 pesos. Costs are relative in relation to the amount of money in circulation. In other words, printing more money means that the currency is devalued, making it less valuable. This makes sense because the more rare something is, the more valuable it is. This is actually why gold was used as a standard for currency long ago and money was actually backed by gold. It isn't anymore and unbacked money is called fiat currency. I could go into a separate conversation about fiat money but it will end up as a lengthy conversation which I have no plans on covering at this time (if you are interested, you are welcome to read up on it on your own).

One way that the US government pays for things is through printing money, which the government uses to pay for goods and services. The government actually makes money come out of thin air and pays for things with it. This is what is often called the "invisible tax" because the money which people have is devalued to let the government pay for things by printing money and increasing the money in circulation. This is the heart of the concept of inflation. In actual fact, the government doesn't actually print it's money, but a government/private controlled bank called the Federal Reserve prints the money and the US government takes loans from this bank to pay for things. But despite this, the fundamentals remain the same.

The effects of inflation and debt on currency valuation (and international trade)

Now this concept becomes very fascinating when it comes to international trade and financing. In order to finance the Iraq war, for example, the US requires resources to wage it's war. It simply just can't print money and distribute it to within the US and expect more resources to come out of thin air-- though money can be created from thin air, resources on the other hand cannot be pulled out of thin air. The US must also trade with other countries to get the resources it requires.

There are two ways which the US can pay for things from another country, the first is through cash payments, which the US must print and distribute to these countries. The problem with this method is that the US must print exorbitant amounts of money to send to these countries which will thus increase the amount of US money circulating in the world and immediately result in the devaluation of US currency.

This is obviously undesirable because you have an effect of diminishing returns. For example, the first time you have to pay $1 billion to get 500,000 barrels of oil. The second time around, you need to pay $1.3 billion to get 500,000 barrels of oil, every time that money needs to be created to buy things, the currency is devalued. This becomes a problem for everyone in the US, especially for international businesses. When the currency becomes devalued, it becomes harder for companies in the US to import things or pay for foreign labor.

For example, if the salary of a Chinese worker was 76,000 yuan a year which costs a US company $10,000 USD to fund. Through currency devaluation, US companies may have to pay $12,000 in salary the next year and then $13,000 a year to fund the same 76,000 Chinese yuan a year of that worker to make goods for import into the US market. Currency devaluation has very serious impacts on international trade. Just to let you know, Apple manufactures its iPods in China and could face rising costs because of the devaluing US dollar. If the US dollar declines too much, Apple may have to increase the costs of an iPod because the US dollar is worth less to pay for things abroad.

Instead of doing this, a second method is used to more gradually increase the amount of US money in circulation which comes in the form of US treasury bonds as loans as mentioned earlier. US treasury bonds are far less liquid (not easily exchangeable) and pay an amount of interest in every period of time (ie. every 3 months, every year etc) . Since treasury bonds is not real cash and because it pays interest gradually, devaluation of the US currency is thus gradual until it has to return the money at the end of the loan term. If the economy is good, the US government will probably have the money in the end and can pay off it's loans without trouble, if it doesn't, the government needs to print the money, resulting in USD devaluation.

Measuring economic health and a country's ability to pay off debt

The alternative to printing money and devaluing the US currency is to produce goods and services that foreign countries want to buy from the US to offset these costs. To explain this, suppose that you have many successful companies in the US making many useful products and exporting them to countries around the world. These companies make money from international trade which is then taxed and becomes money that the US government can use to run programs and/or pay off it's debt. The more successful the US companies are, the more income the government can make and the easier it is for the government to pay off the debt.

So, then, let's take a look at the trade balance of the US in international trade which I have taken from wikipedia and is posted below for reference.

The US trade deficit since 1991

By looking at this chart, we can observe that for the past 14 years that the US trade deficit has been increasing yearly and becoming more and more negative. What this means is that the US is borrowing or paying out more and more money yearly because it imports more than it exports.

I see two possible causes for this problem. The first possible cause is that US per capita consumes far too much and it driving itself into debt from over consumption. The second reason is a result of economic weakness of the US in the international market leading to exports not keeping up with imports. I believe that the US faces a combination of both problems due to outsourcing of work and manufacturing and massive imports from other countries like China. What this means is that the US is getting goods from imports while not producing enough exports to keep a fair balance in trade.

The current US economic future is DOOMED

Based on increasing governmental debt and the growing trade deficit, the US economy will continually get worse. The US debt and the trade deficit is increasing yearly, meaning that the US currency will be further devalued. As many US companies have outsourced or import goods from abroad, the outsourced work and goods will become more expensive, thus diminishing the profits of US based companies. Imported goods will be less affordable in the future, reducing the purchasing power of the ordinary citizen... whom are already in debt with high loans and interest rates.

The prospects for the US economy are grim and I would advise against making long term investments in the US due to weakening economic conditions. The currency will continually drop as the economy weakens. An economic crash may occur in the US which may bring down the currency further. Investing in the US might become good after this crash when the economy has stabilized and the currency is cheap enough for international companies to consider investing in the US.

Though this is speculative, I believe that poor foreign and local economic policies have led to increased governmental debt and the weakening of the US economy. The problem is largely due to the government spending too much on the Iraq war and then requesting that US citizens spend more (as in take on more debt) to finance the government debt through taxes. I do not believe that the US economy will be able to support the debt in the future, unless changes are made. The US government has made poor financial decisions and despite it's poor approval rating of 29%, the general population has done a poor job of holding the government accountable.

As a result of these findings, I believe that exposure to US currency should be reduced (ie. if you have US money, sell it off). Warren Buffet has also made a similar play a few years ago by selling his US money against other currency in 2002. I also advise against investing money in the US index funds which are measuring the metrics of the US economy and would invest outside of the US.

It is unfortunate that the future of the US economy looks like this and the impact it will have on it's citizens, but until attitudes change, nothing much can be done to change the current state of things.

2 comments:

Saving is for suckers, fiat money makes it impossible for anyone to save in money. If you want to save for the future you either need to invest in something that will generate money(Not stocks(Dependent on the currency as well)) like a business or something that will produce goods and services to people or you get something that will retain in value over time, estate is a bad idea as it needs maintenance.

Your argument has some flaws.

First, the value of a currency is affected by inflation and fiscal (deficit/debt) factors, but confidence in the country's ability to pump out wealth is a major factor which you are overlooking.

For example, Japan has increased its debt to GDP ratio enormously over the past decade (I think they're up to 150% or so) but its currency has not tanked.

Your focus on war spending is not the whole picture - the majority (just over 50%) of US budget expenditures relate to social security/medicaid/welfare/medicare. Defence is about 15%.

Finally, if the US is doomed, how come international investors are willing to receive 5% over 10 years for US bonds? Surely if the US economy and currency was in dire shape that they would ask for more of a return from US government debt.

-----

Lord Metroid - investment in companies that will generate cash flows is the best hedge against inflation.

Post a Comment